As we step into 2024, the investment landscape continues to evolve, presenting new opportunities and challenges for investors. Navigating this dynamic environment requires strategic thinking and informed decision-making. Michael Shvartsman, an experienced investment expert, shares his insights on how to make the most of your investment portfolio in the coming year.

- Diversify Your Portfolio.

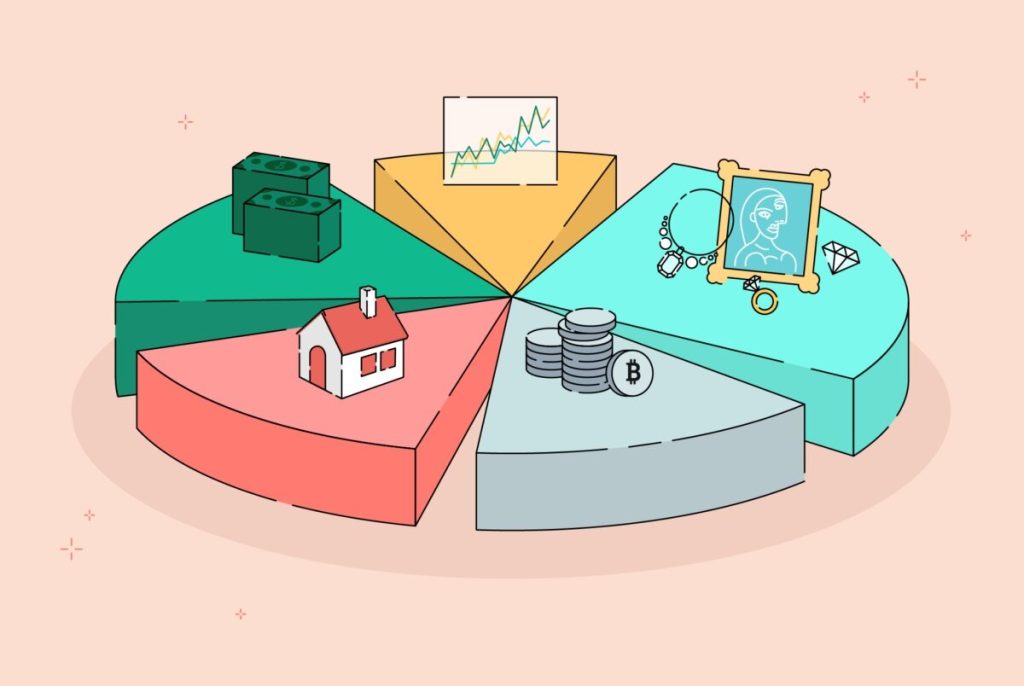

Diversification remains a fundamental principle of smart investing. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce risk and enhance potential returns. “In 2024, consider balancing traditional investments like stocks and bonds with alternative assets such as real estate, commodities, and emerging market equities,” advises Michael Shvartsman. “This approach helps to buffer against market volatility and economic uncertainties.”

- Embrace Technology and Innovation.

The rapid pace of technological advancement continues to reshape industries and create new investment opportunities. From artificial intelligence and blockchain to renewable energy and biotechnology, investing in innovation can yield significant returns. Michael Shvartsman emphasizes, “Investors should look at companies driving technological progress and those that are early adopters of disruptive technologies. These entities are likely to thrive and deliver strong performance.”

- Focus on Sustainable Investing.

Sustainable investing has gained considerable traction as environmental, social, and governance (ESG) factors become increasingly important. Companies that prioritize sustainability are better positioned to succeed in the long term. “Sustainable investing is not only about ethical considerations but also about identifying companies that are adapting to regulatory changes and shifting consumer preferences,” says Michael Shvartsman. “In 2024, investors should seek out businesses with strong ESG practices, as they tend to be more resilient and forward-thinking.”

- Monitor Economic Indicators.

Keeping an eye on economic indicators can provide valuable insights into market trends and potential investment opportunities. Factors that can significantly impact various asset classes are:

- interest rates,

- inflation,

- employment rates.

Michael Shvartsman advises, “Stay informed about macroeconomic trends and how they affect different sectors. This knowledge can help you make timely adjustments to your portfolio and capitalize on emerging opportunities.”

- Consult with Financial Advisors.

In an ever-changing investment landscape, seeking professional guidance can be invaluable. Financial advisors can provide personalized strategies tailored to your financial goals, risk tolerance, and investment horizon. “Working with a knowledgeable advisor can help you navigate complex financial markets and make informed decisions,” notes Michael Shvartsman. “They can offer insights and recommendations based on thorough analysis and experience, ensuring your investment strategy is aligned with your objectives.”

Expert Opinion: Michael Shvartsman.

Reflecting on these tips, Michael Shvartsman underscores the importance of staying adaptable and informed in 2024. “Investing is a dynamic process that requires continuous learning and adjustment. By embracing diversification, technology, sustainability, and professional advice, investors can position themselves for success in the coming year,” he concludes. “The key is to remain proactive, stay abreast of market developments, and make strategic decisions that align with your long-term goals.”

As we move forward into 2024, these insights and strategies can serve as a guide for investors looking to navigate the complexities of the financial markets and achieve sustainable growth in their portfolios.